I Canceled My Family's Health Insurance (and joined CrowdHealth)

How it works and why it made sense

I never want to be someone who complains about a problem I’m doing nothing to fix.

Yet for years, I have been.

With Cosette (my wife) and I being self-employed, we’ve had to figure out our own health insurance since 2021.

And each year I’ve watched the price go up, especially as we’ve had more kids, my frustration with the difference between what we’re paying and what we’re getting steadily rising.

The last straw came this fall. Our pediatrician informed us they would no longer be accepting our health insurance, and on top of that, we had to pay thousands of dollars for some testing that they mis-billed and insurance wasn’t covering.

So I started the search that has left so many people shocked this year, and discovered we’d have to pay around $3,000 a month for a family of five for the same level of coverage we had before.

That might be tolerable if we got $3,000 a month in value for our health insurance, but it’s nowhere close. Hardly anything we already do for our health is covered by it. All three of our births we’ve paid out of pocket. We get blood work on our own. We hire fitness trainers. We don’t have any preexisting conditions or medications. And the one thing we did use insurance for, our pediatrician visits, would cost significantly less than $3,000 a month out of pocket.

The conversation I kept having with people the last few months was basically: “I’ve been doing the math and I don’t think health insurance is worth it anymore.”

Why pay $36,000 a year for a service we’re not really using, and which we might have to fight tooth and nail to get our money in the event we do need to use it?

I floundered in this grey space for a month, pulled back and forth between “this is way too expensive to make sense” and “you’d be an idiot not to have health insurance for your family.”

Then, finally, I found a solution.

A friend posted on X about his own thoughts along my lines, and another mutual replied mentioning CrowdHealth.

I’d heard of them over the years since they launched, and they’d come up as an option during my research, but I hadn’t felt confident it was a good option. It sounded too good to be true. But spurred by his mention and the endorsements of people in the comments, I decided to dig in deeper.

And, well, it was exactly what I was looking for. I scrapped my plans to pick a new health insurance plan, signed up for CrowdHealth, and it honestly feels like a massive weight off my shoulders.

I’ve gotten a ton of questions about it on X, so I thought it would be worth sharing how I ended up making this decision and why I think it’s the right one for my family.

Maybe it’s the right one for yours, too.

Two Notes Before We Continue

The Referral Network: As I’ve done on this blog for over a decade, I’m writing this post because CrowdHealth is something I discovered that I’m extremely excited about. They also have a referral program, and whenever I link CrowdHealth in this post I’m including my referral code, which gets you a discount on your first few months and gives me a referral bonus.

I would have written about CrowdHealth even if they didn’t have this program though. And if you’d like to sign up without giving me credit for referring you, use this link: No Referral.

CrowdHealth’s CEO: When I asked people what they wanted me to include in this piece on X, the CEO of CrowdHealth reached out to me and offered to take a look at the piece before I published it.

He corrected a couple small details I got wrong, but did not influence the tone, voice, or pros and cons in the piece at all.

I will say I’ve been pretty inspired by how active the CrowdHealth team is on social media. As you can see from the X post, they jumped right in and started answering people’s questions.

Anyway, onward!

Why Insurance Wasn’t Working for Us

I’m probably 10-20 pounds heavier than I should be, I have high cholesterol, but all things considered, I’m in excellent shape by national standards. My VO2 Max is 50, I can lift twice my bodyweight off the ground, I get excellent sleep, we cook most of our meals, I get bloodwork done and make tweaks in accordance with it. Cosette is arguably even healthier.

In the 8 years we’ve been living together, we’ve only been to an ER twice. Once when she dislocated her elbow, and again when our daughter fell and split her forehead open. No annual physicals, no medications, no chronic conditions.

Our biggest health expenses and investments haven’t been covered by insurance. We can’t charge for our food choices or our fitness. All three births we’ve paid for out of pocket since midwives, doulas, and the one birth center we did weren’t covered.

But during those 8 years, we’ve spent somewhere around $100,000 - $150,000 on health insurance. So we’re deeply in the hole on our health insurance spend, losing tens of thousands of dollars a year for effectively nothing.

Now, I know the big obvious caveat here: health insurance is for the things you don’t expect. The car crash, the cancer, the home birth complications. And that caveat was how I kept justifying it for so long.

But as the costs have risen and as our health has continued to improve, the math started making less sense. If something catastrophic happened, we’re fortunate enough that we could cover the costs by dipping into our investments. Investments which we’d have much more money to put towards if we weren’t spending $36,000 a year on health insurance.

And even if we did develop a chronic condition that required ongoing treatment, there would still be the question of whether that cost was less than the cost of insurance, especially once you factor in the savings of not paying insurance for so many years.

So this was the math I started thinking about. Self insurance through an HSA or something was starting to get very appealing. But even so, I was still worried about having some protection in the event of a sudden unpredictable event.

Before I found CrowdHealth I was pretty seriously leaning towards self-insurance. But I think CrowdHealth is the better option for someone in a similar situation to mine.

What is CrowdHealth

CrowdHealth is the happy medium between taking your health risks completely into your own hands, and being stuck in the current health insurance hellhole.

Each month, you pay a flat monthly fee, and then up to a certain amount on top of that towards other member’s healthcare costs. For my family of five, the flat fee is $295, and then we pay up to $400 a month towards others’ costs.

Off the bat we’re talking about a cost reduction from $3,000 a month to $695, which is what set off my “this is too good to be true” alarm bells. But as I dug into how it works, the math started to make sense.

How it Works

When you have a health event, you submit it to the “crowd,” and they reimburse you, with a couple caveats.

Let’s use my wife’s elbow dislocation as an example for how it works. She fell at a bouldering gym and we had to call an ambulance and go to the ER for them to fix it. After everything was done, instead of giving them my insurance information, I would have told them I was a cash payer and asked for the bill.

Then I upload the bill to CrowdHealth. They contact the hospital and handle negotiating it down as much as humanly possible. Then once they have the price down, they spread it out across the members in their network, with us on the hook for $500 of it.

If the bill came out to $20,000, they might break that down into 200 payments of $100 and ask 200 people to contribute. Anyone who contributes to that bill would be paying towards their monthly contribution limit.

CrowdHealth sends the money to our bank account, I pay the hospital, and we’re done. If we end up with any other bills we just submit those the same way.

As a member, you have a “generosity score” that reflects how reliable you are about contributing to other people’s bills. If you have autopay turned on, this will always be 100 and you won’t have any issues. But if you don’t contribute towards other people’s bills, then when you end up submitting a request other members will have the option to not pay your bill at no penalty to them.

So everyone’s incentivized to keep helping each other out because one day you might be the one that needs help.

But that’s basically how normal insurance works too, so how is the cost so low?

How The Cost is So Low

You can’t join CrowdHealth if you’re not reasonably healthy. And by excluding unhealthy people, they’ve created a better, cheaper option for healthy people.

During the intake form, they ask if you were ever a regular tobacco user, or if you weigh over a certain amount (260 for men, 220 for women). If you say yes to either, you can’t join.

By excluding obese people and smokers, they’ve already cut the cost of healthcare significantly, since those are the two most obvious sources of higher healthcare costs.

Maybe you feel a sense of moral duty to pay for medical care for those demographics, but I don’t. I absolutely want to contribute to the care for a kid who needs emergency surgery through no fault of their own. But if someone has made poor lifestyle choices, that’s not my problem.

CrowdHealth also make joining reasonably unattractive to anyone with a preexisting condition. You aren’t excluded from joining if you have one, but you can’t bill anything related to that condition to the network until two years after you join.

So among those three exclusions, they’re naturally creating a pool of people with much higher average health than the American baseline.

The other area of their process where they can save quite a bit is through their handling of the cash price negotiations.

During my diligence, I got on a call with someone from their team and asked about the most expensive procedure they’d covered. He shared an example from last year where someone had a serious cancer diagnosis that resulted in a bill for $1 million. They negotiated it down to $250,000.

That’s still a huge bill, but break it down into $250 payments, and it only has to be paid by 1,000 people, less than 10% of their 15,000 person network.

So the math was starting to make sense at this point, but there was another very obvious way they could be keeping the cost down: denying people coverage.

Which led to my next question: how many of these bills actually get paid?

Do The Bills Actually Get Paid?

When you sign up for CrowdHealth they make it very explicit that this is not health insurance and they cannot guarantee coverage. They technically call it “funding” instead of “covering.”

Now off the bat, it’s worth recognizing that regular health insurance doesn’t cover you in 100% of situations either. I got a bill from our pediatrician last month for a few thousand dollars because United Healthcare told them they wouldn’t pay for one of our kids’ physicals because their tests weren’t done in the VERY SPECIFIC WAY they have to be done to be covered.

And there are plenty of more dramatic stories. Roughly 19% of in-network claims, and 37% of out-of-network claims, end up getting denied by insurance. I only learned that while doing the initial research and was shocked, that’s much higher than I thought. When you pay for insurance you tend to assume that if something bad happens you’ll be covered 100% of the time, not 81%!

So theoretically, if CrowdHealth is funding at least 81% of the requests, they’re doing as well as insurance.

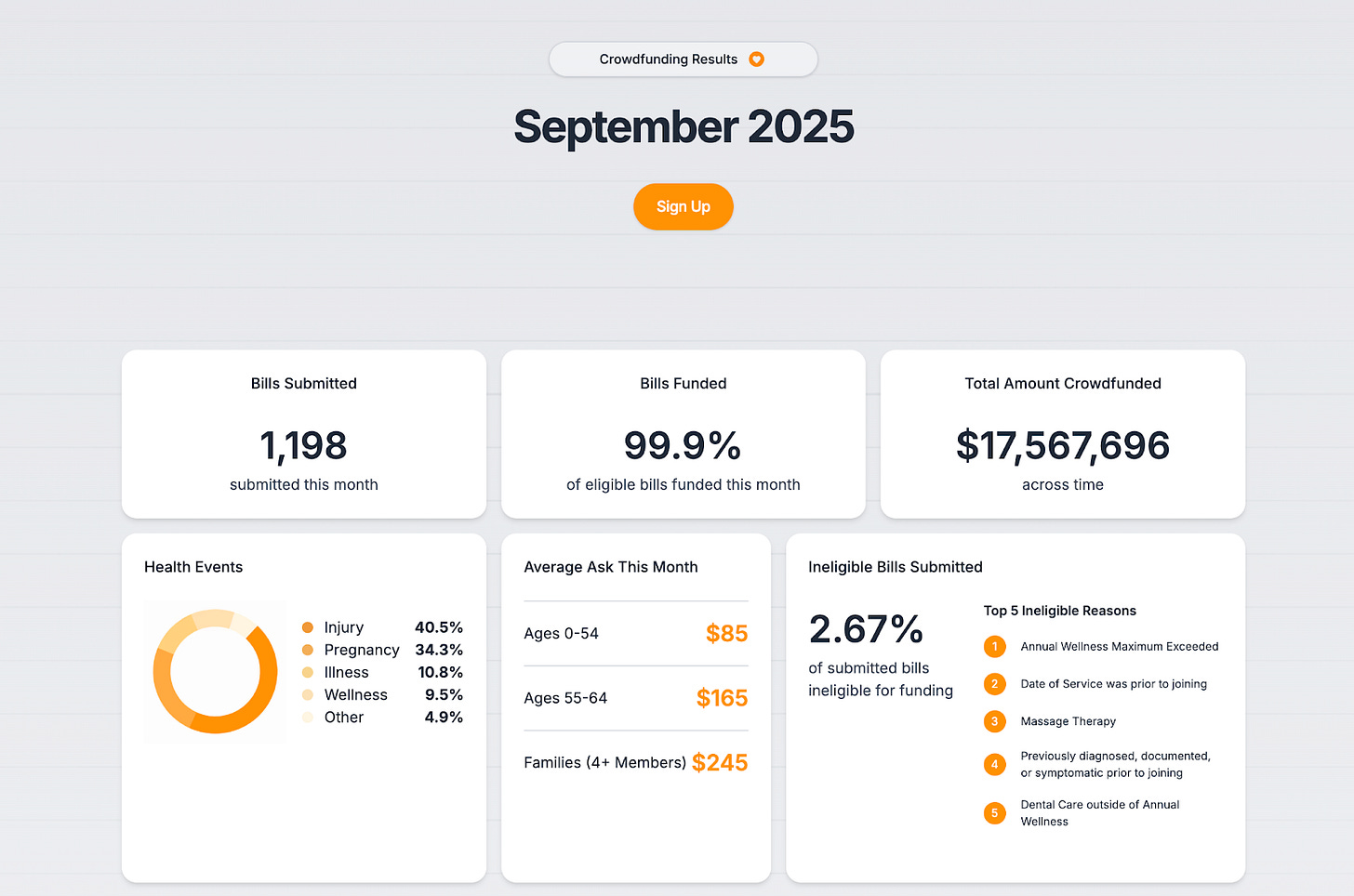

This was what led me to the last piece of the puzzle and gave me the confidence to pull the trigger. CrowdHealth publishes the data on every single healthcare request they receive and whether or not they funded it.

It’s a ridiculous degree of transparency for a healthcare company. Imagine United Healthcare or Aetna publishing something like this. And if you scroll through it you can see their coverage ratio month-by-month, as well as what bills weren’t covered and why they were denied.

Their denial rate for September was 2.67%, and most of those were cases where a member tried to submit something they should have known wouldn’t be covered in the first place.

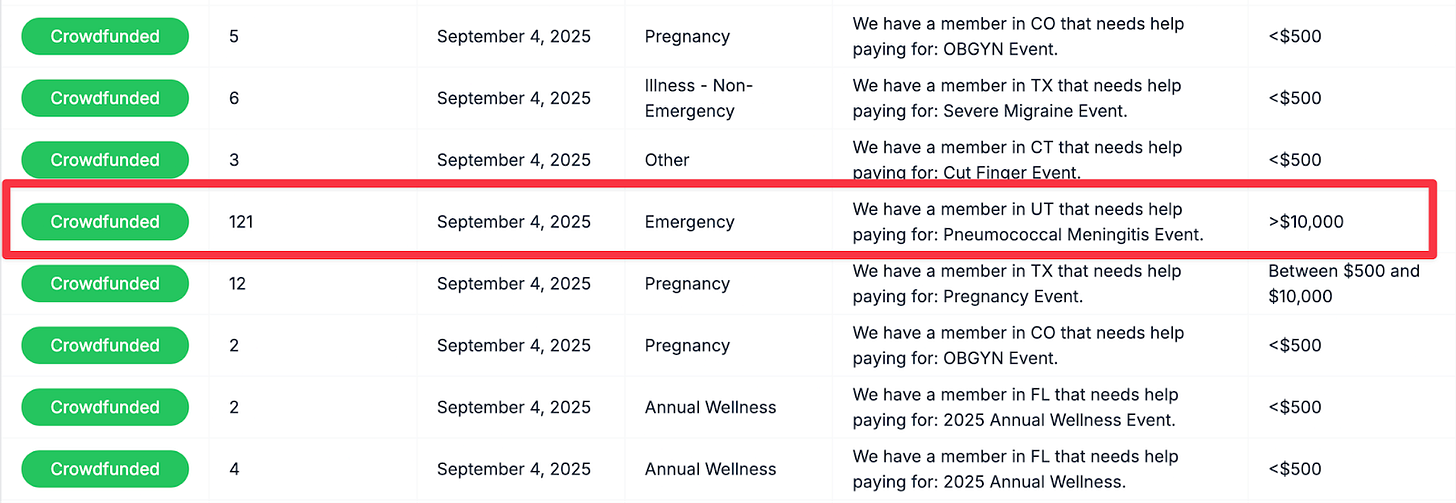

You can also see everything that was funded. Like this example of a Pneumococcal Meningitis Event where over $10,000 was funded by spreading it out across 121 members.

Now that said, there are some things that aren’t covered that could give you legitimate concern. If you were symptomatic or diagnosed before you joined, that will get denied. As will anything related to preexisting conditions for the first two years, as I mentioned above.

But if you submit something and it gets denied, there’s an appeal process. CrowdHealth has a volunteer panel of five members from the community who review contested decisions. You submit a statement, CrowdHealth submits a statement, and then the panel votes on whether you should be funded or not.

But there’s one last category where your care might get denied that I was the most worried about, which is their “fair pricing” rule.

The Fair Pricing Rule

Let’s say that Cosette ended up needing corrective surgery for her elbow after the initial emergency room visit. CrowdHealth doesn’t lock you into a network and you’re free to go to any doctors or specialists you want, but your costs are only funded if the provider offers a “fair price.”

The fair price is decided by looking at the average cost for a procedure across the hospitals in your region. CrowdHealth calculates an average price, and recommends doctors within that price range, allowing you to go up to 20% above the fair price.

If you wanted to go to the absolute #1 best surgeon in your region, and they charged more than 20% above the market rate, you would not be fully funded. CrowdHealth would fund up to 120% of the fair market amount, but above that you’d be on your own. It’s worth noting too that this is only for very large bills like surgeries. It’s not for normal specialist visits or primary care visits.

I ultimately decided this was fine since it’s how they can manage the cost of the membership. For most trips to a hospital you do not need the #1 best in the world, and in the event my family ever does, I’m fine paying some of it out of pocket for that extra level of care. Especially since I’m saving ~$27,000 a year.

Assuming something truly horrible happens, it’s still a much better situation to be in than I would be if I did self-insurance.

What About Your Kids?

This is the question I’ve gotten the most, and it was my biggest concern going into it. Kids are naturally a big source of healthcare costs and healthcare anxiety. So I’ll break it out into four categories. Ultimately in my case the savings were overwhelming compared to the slight increase in costs for getting care for our kids:

Childbirth

For every medical event you submit bills for to CrowdHealth, you have to pay the first $500. Except for childbirth, where your initial commitment is $3,000.

On the one hand that feels a bit unfair, but plenty of health insurance plans have a higher deductible than $3,000 for everything, and in our case, we can actually use CrowdHealth for midwife and doula care, so we’ll save ~$7000 on any future births. I wish I had signed up four years ago.

If you’re doing a hospital birth, you’ll end up paying more than you would on insurance, unless your deductible is over $3,000 and you have no other healthcare expenses that year. But you still have to weigh that against what you’re saving from the switch.

Kid Wellness

Before CrowdHealth, our in-network co-pay for kids wellness (their normal physicals) was $20 a visit.

On CrowdHealth, we have to pay the first $500 for wellness expenses for our kids from 0-6mo then CrowdHealth pays the rest, and then it resets for 7-36mo with the same deal.

Once they’re 3 they’re normal members with a $300 annual wellness credit.

So we’ll be spending a little more out of pocket for our kids’ pediatric visits, probably ~$800-900 per kid, but we’re saving more than that per month. Plus, the risk of something getting denied is significantly lower.

Kid Emergency

Our oldest daughter fell and split her forehead open when she was about 2. We rushed her to the ER, got in quickly, they stitched her up and sent us home, and sent the bill to insurance.

If I remember correctly, our health insurance at the time had a lower deductible, around $2,000, so that’s probably all we paid. Maybe less.

On CrowdHealth, we would have gotten the cash bill, sent it to CrowdHealth, and then they’d negotiate it down. But whatever they negotiated it down to, our contribution would have been $500, so we’d save money in this example.

Chronic Conditions

Again, we’re fortunate to have very healthy kids with no conditions that require ongoing care. If you do, then CrowdHealth probably isn’t the right choice, since the first two years of their coverage for those conditions won’t be covered.

The math MIGHT still work out assuming you’re going to be on it for 5-10+ years. But you’d have to calculate that out yourself.

So Who Is It Not For?

CrowdHealth definitely doesn’t make sense for you if:

You’re over the weight limit

You’re a current or former tobacco user (3+ months of daily use)

CrowdHealth is probably not for you if:

You have an expensive chronic condition you need coverage for

You have incredible free health insurance from your employer

CrowdHealth is maybe not for you if:

You live in a state where there’s a health insurance mandate, and you’ll be fined for not having true health insurance. These states are California, New Jersey, Massachusetts, Rhode Island, and the District of Columbia.

You’re borderline unhealthy, very worried about the worst case scenario and would be financially ruined if it happened. Basically if you’ll lose sleep from this choice.

You feel a sense of duty to pay for other people’s healthcare, regardless of their choices

What’s The Worst Case Scenario?

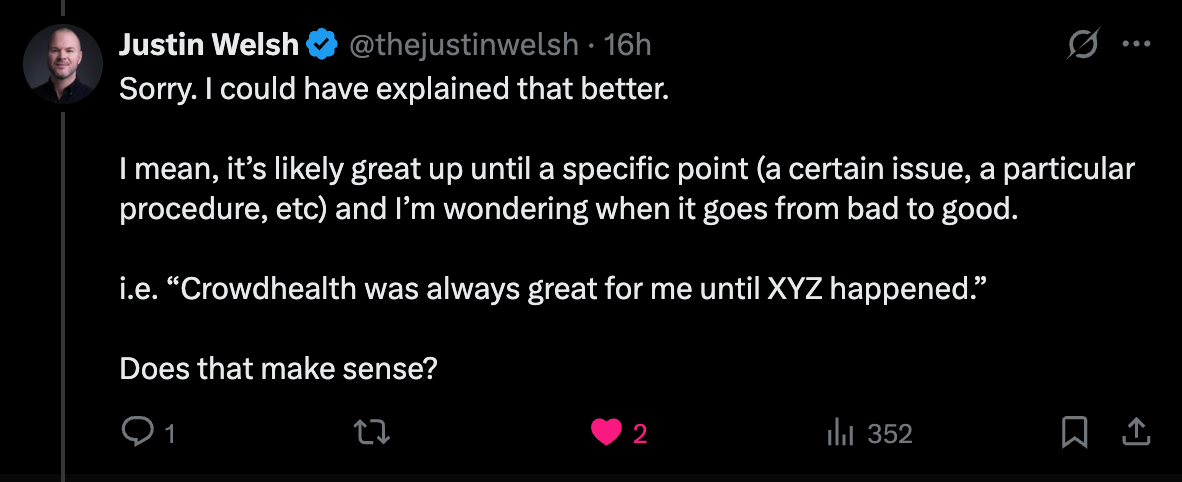

Justin Welsh asked this question on X and I thought it was a good one:

The one risky “gotcha” I can imagine is where you have something like kidney failure and then need to get on dialysis for an unknown period of time.

You’d only be covered for that ongoing treatment for the first year, after that you’d be on your own, which could easily be $100,000+ per year.

You could quit CrowdHealth and get back on normal insurance, but if the legislation changes and health insurance companies no longer have to accept people with preexisting conditions then you might not be able to do that either.

So if you end up in that situation you’re going to have a bad time. The odds are low, but it’s worth knowing that it’s possible.

Other Questions

What About High Cholesterol (or other risk factors)?

This is another topic I was interested in since I have higher cholesterol. Thankfully high cholesterol alone is not considered a preexisting condition, so if you join and then have a cardiac event you’ll be covered.

But if you’ve already had a cardiac event, or been diagnosed with something related, then your related care wouldn’t be covered until two years after you’ve been a member.

Adult Wellness?

Every member gets a $300 credit per year to use towards “wellness” visits. This could be bloodwork you get done yourself, an annual physical, the dentist, whatever. After that you’re on your own.

That might be an issue if you take advantage of your insurance to get tons of preventative stuff done on their dime, but it’s not something we were able to do for almost anything before anyway so this is a nonissue for us, especially once the savings are factored in.

What if CrowdHealth Shuts Down?

Then we’d just join another crowd-sourcing healthcare company, or worse-case, get back on Obamacare.

How Liquid Are They? What If There’s a Really Bad Month?

CrowdHealth doesn’t disclose how much cushion they have on their balance sheet so I’m not sure on the first part. But they’ve never yet had the member bills for a month exceed what they can cover with the crowd, and in the event it ever did happen, they’d roll the excess into the next month as the top priority bills.

This is one legitimate black swan risk, though. If five people in the crowd had $1m bills in a month I don’t think they’d be able to cover it immediately.

What if You Don’t Like it? Can You Cancel?

You’re not locked in, so you can quit and go back to normal insurance anytime.

Which Doctors Can You See?

Any you want. Though if you go to a particularly expensive one, you’ll need to pay the difference between the 120% of market rate (explained above) and what the doctor you see charges.

Do You Need Specialist Referrals?

No!

What About Long-Term Prescriptions?

If you get prescribed a drug from a health event, CrowdHealth covers that no problem.

But if you require medication in perpetuity, they only cover the first year. So if you’re on ADHD meds, SSRIs, Statins, you’re going to pay those out of pocket.

Now that said they give you access to an RX Card that cuts the cost by ~50%, and you might save more than the cost of your medication from the switch, but it’s worth running the numbers on that if it applies to you or you think it might apply to you in the future.

How Long Does It Take to Get Paid?

Based on their data you usually get paid in under 7 days, pretty much always in 14. As Cosette reminded me when I was writing this, we were dealing with hospital bills and insurance from her arm for a year after it happened, so having everything wrapped up in two weeks sounds great.

Are You Constantly Reviewing People’s Funding Requests?

No, you only get 1-2 per month, and assuming you have autopay on then you’ll automatically fund them assuming the member making the request has a high generosity score. It’s pretty much set it and forget it.

Health Insurance Won’t Change On Its Own

The last thing that pushed me over the edge here was a sense of duty to help nudge health care in a better direction.

I’ve been complaining about health insurance for years, but still forking over tens of thousands of dollars a year to support their broken business.

Voting with my dollars is a way to push the industry in a better direction.

Obviously if my feelings on the program change I’ll write an update, but I’m very excited to be part of the crowd.

If you have any follow up questions from reading this piece, drop them in the comments. I suspect someone from CrowdHealth will pop in and answer them.

Thanks for reading! Before you go, grab a copy of Crypto Confidential or my sci-fi thriller Husk.

Similar age / life stage here. US resident. We’re young and healthy. First kiddo was a textbook, easy birth. A few years later my wife got pregnant again (identical twins!) and developed twin-to-twin transfusion syndrome. It’s not genetic — just terrible luck. Without treatment, both babies would have died.

She had fetoscopic laser surgery in utero, where they go in with a tiny scope and laser to seal off the abnormal shared blood vessels. Even with that, she went into labor at 25 weeks.

One baby died less than 24 hours after birth. The other twin spent over 100 days in the NICU.

Total bill was about $2,500,000. You read that right.

I love the idea, but be careful — never in a million years did I think something like this would happen to us. I’m incredibly grateful we had solid health insurance. We probably paid under $10k out of pocket for the whole ordeal.

Thanks for writing this Nat, very helpful overview.

Thinking of making the switch myself and working through it. Dropping a thought here with the hope someone else knows more than I do about it.

You noted in the black swan risk about them shutting down or not being able to make payments. I believe there is some history of this with these organizations. Liberty Health Share shut down and didn't pay out claims I think in 2020 and Trinity similarly did.

As I understand it, there was some fraud (or close to fraud behavior like spending contributions on things other than medical cost sharing).

Ultimately, I'm not sure how to underwrite this for a private, unregulated company. I love the dashboard showing they are paying things out, but that doesn't really give you a sense of the backstop.

I get that you could switch back to an ACA plan, but my understanding is that CrowdHealth going out of business would not be a qualifying event so you're waiting until open enrollment.

The concerning scenario is they go out of business or stop paying claims in March and you're basically uninsured for 9 months until Open Enrollment hits again. If you were already comfortable self-insuring then maybe not an issue.

In my mind, health insurance's purpose is to help an individual turn an uncapped, but diversifiable risk into a capped risk by pooling with other individuals. The odds of getting cancer at 40 are low, but it would be devastating financially so spreading that risk around is a win, win. The traditional model does this but pools you with a lot of higher risk people (among other issues).

It's fair to say that insurers can also deny claims anyway if they want, but there is some regulator body to appeal to and I believe most states have guaranty funds to backstop them.

This seems like the most critical issue, but I really have no idea how to underwrite it. If CrowdHealth was larger and had a publicly audited backstop of some sort, that would make me a lot more comfortable. Most anecdotal stories from both camps are good, it's all about what happens in the tails and I'm not sure how to evaluate that.